Insurance Coverage: Protecting Families From Unexpected Financial Shortfalls

Life has an uncanny way of throwing curveballs. One moment, everything feels stable; the next, an unexpected illness, accident, or natural disaster can threaten to unravel years of careful financial planning. This is precisely where comprehensive Insurance Coverage: Protecting Against Unexpected Financial Shortfalls steps in, acting as the bedrock of a secure financial future. It’s not just a product you buy; it's a proactive strategy to safeguard your income, assets, and the well-being of your loved ones against life's inevitable uncertainties. Think of it as building a sturdy financial fortress, brick by brick, against the unpredictable storms ahead.

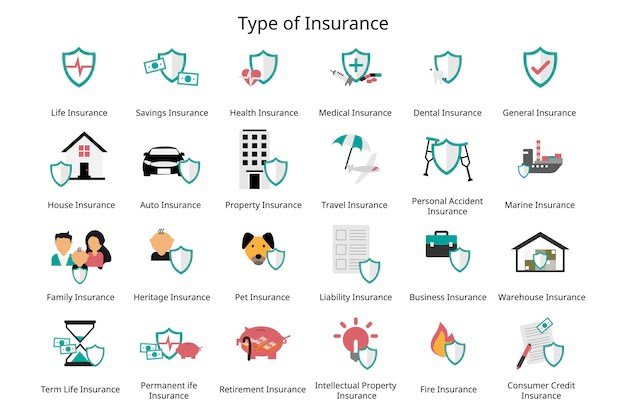

At a Glance: Your Insurance Essentials

- Financial Safety Net: Insurance transfers the risk of significant financial loss from you to an insurer, providing a crucial safety net.

- Peace of Mind: Knowing your family and assets are protected allows you to live with less anxiety about potential crises.

- Beyond Emergencies: It secures your income, protects your long-term assets, and even helps facilitate leaving a legacy.

- Tailored Protection: The right coverage isn't one-size-fits-all; it's specific to your income, debts, assets, and family situation.

- Stay Flexible: Your insurance needs evolve. Regularly review policies, especially after major life events, to ensure they still fit.

- Know Your Policy: Understand what's covered, what's excluded, and how to file a claim before you need to.

The Foundation of Financial Security: Why Insurance Matters More Than Ever

In an increasingly unpredictable world, the concept of a "rainy day fund" is vital, but even the healthiest savings account can be quickly depleted by a catastrophic event. That’s where insurance provides an essential layer of protection, allowing you to transfer the burden of potentially devastating financial losses to an insurer. It's a strategic partnership designed to provide financial security and, perhaps more importantly, profound peace of mind.

Imagine facing a sudden medical emergency, a devastating fire, or the unthinkable loss of a primary income earner. Without insurance, these events don't just create emotional distress; they can trigger a domino effect of financial ruin—depleting savings, accumulating debt, and forcing difficult life choices. Insurance serves to prevent these shortfalls, securing your present well-being and paving the way for a more stable future for your family and your legacy.

The Essential Pillars of Protection: What Every Family Needs to Consider

Building a robust insurance portfolio means understanding the different types of coverage available and how each addresses specific risks. It’s about creating a comprehensive shield, not just patching up a few holes.

Safeguarding Your Income: Your Most Valuable Asset

Your ability to earn an income is likely your greatest financial asset. Protecting it means ensuring that your lifestyle, debts, and future goals remain viable, even if you can no longer work.

- Life Insurance: Protecting Those Who Depend On You

Life insurance isn't for you; it's for the people you leave behind. Should the unthinkable happen, it provides a tax-free lump sum or income stream to your beneficiaries. This critical payout helps them maintain their lifestyle, cover daily expenses, pay off debts (mortgages, car loans, credit cards), fund children's education, and even plan for retirement. It's about ensuring your loved ones aren't left in a financial void, struggling to make ends meet while grieving your loss. Without it, your family might find themselves in the same bind, wondering how to cope financially—a situation that no one wants to see their loved ones in, leaving them feeling like they're starting a day late and a dollar short. - Disability Income Insurance: Protecting Your Paycheck When You Can't Work

Many people underestimate the risk of becoming disabled, even temporarily. An injury or illness that prevents you from working—whether for a few months or several years—can swiftly derail your finances. Disability income insurance replaces a significant portion of your lost income, typically between 50% and 70%, allowing you to continue paying your bills, maintaining your living standard, and focusing on recovery without the added stress of financial collapse. This protection is vital, as government benefits or employer-provided short-term disability often aren't enough to cover long-term income replacement needs.

Protecting Your Health & Long-Term Assets: Beyond the Immediate

While income is crucial, your health and the assets you’ve accumulated over a lifetime also demand comprehensive protection. Healthcare costs, especially for long-term care, can be astronomical.

- Medical Insurance: Your Shield Against Healthcare Costs

Medical insurance is non-negotiable in today's world. It protects you against the significant financial hardship of major medical events—hospitalizations, surgeries, and chronic illnesses—which can quickly rack up six-figure bills. Beyond emergencies, it also covers preventative care, doctor visits, prescription drugs, and diagnostic tests, helping you stay healthy and catch issues early. Having adequate medical coverage means you can make healthcare decisions based on your well-being, not just your wallet. - Long-Term Care Insurance: Preserving Your Legacy and Dignity

As lifespans increase, so does the likelihood of needing long-term care, whether at home, in an assisted living facility, or a nursing home. These services are incredibly expensive and typically not covered by standard medical insurance or Medicare. Long-term care insurance helps cover these escalating costs, protecting your assets from being depleted to pay for care. It ensures you receive the care you need without becoming a financial burden on your family or sacrificing the legacy you intended to leave behind.

Safeguarding Your Property & Liability: From Home to Highway

Your physical assets—your home, your car, your possessions—represent substantial investments. Protecting them from damage, loss, and the ever-present threat of liability claims is fundamental to financial security.

- Auto Insurance: Mandatory Protection on the Road

If you drive, auto insurance isn't just a good idea; it's legally required in most places. Beyond covering damage to your own vehicle, it's primarily designed to protect you from liability if you cause an accident that injures others or damages their property. Medical bills, lost wages, and property repairs can easily total hundreds of thousands of dollars, making robust liability coverage essential. Collision and comprehensive coverages then protect your own car from damage due to accidents, theft, or natural events. - Homeowners Insurance: Protecting Your Sanctuary

Your home is likely your biggest asset, and homeowners insurance is its fortress. It protects against damage to the structure itself from perils like fire, storms, and vandalism. It also covers your personal belongings inside the home. Crucially, homeowners insurance includes liability coverage, protecting you financially if someone is injured on your property or if you accidentally cause damage to someone else's property. Without it, a single unforeseen event could force you to rebuild your life from scratch. - Renter's Insurance: Essential for Those Who Lease

Many renters mistakenly believe their landlord’s insurance covers their belongings. It doesn't. Renter's insurance is an affordable policy that replaces your personal property if it's stolen, damaged by fire, or lost due to other covered perils. Like homeowners insurance, it also provides vital liability protection if someone is injured in your rented space or if you accidentally damage the property of others. It’s a small price to pay for significant peace of mind. - Umbrella Insurance (Excess Liability Insurance): The Ultimate Safety Net

What happens when the liability limits on your auto, homeowners, or renter's policy aren't enough to cover a major claim? Umbrella insurance kicks in. This excess liability policy provides an additional layer of protection, typically in millions of dollars, above and beyond your existing policies. It can cover not only severe injury claims but also legal fees and damages from claims like libel, slander, or defamation, which are often excluded from standard policies. It’s particularly valuable for individuals with significant assets to protect, as it shields them from potentially devastating lawsuits.

Navigating Your Coverage: Key Steps to Get It Right

Understanding the types of insurance is the first step; the next is strategically building your personal portfolio. This isn't a one-time task but an ongoing process that adapts to your life.

1. Assess Your Unique Needs: The Blueprint for Protection

Before you buy a single policy, take stock of your current situation. This comprehensive assessment is the foundation of smart insurance planning.

- Income & Debts: How much do you earn? What are your monthly expenses? What debts do you carry (mortgage, student loans, car loans)? These figures dictate how much income replacement and debt coverage you'll need.

- Assets & Savings: What assets do you own (home, car, investments)? How much is in your emergency fund? Your assets determine what needs protection and what you could potentially self-insure against minor losses.

- Family Size & Dependents: Do you have a spouse, children, or elderly parents who rely on you financially? The more dependents, the greater the need for income protection and life insurance.

- Short-term & Long-term Goals: Are you saving for a child's college, a new home, or retirement? Insurance helps protect these goals from being derailed by unforeseen events. Your evolving aspirations directly impact your coverage needs.

2. Shop Smart: Comparing Policies and Providers

Once you know what you need, it's time to shop. Don't settle for the first quote.

- Compare Coverage Options: Look beyond just the premium. What exactly is included? What are the deductibles (the amount you pay before insurance kicks in)? Are there specific exclusions that might impact you?

- Premiums vs. Value: The cheapest premium isn't always the best deal. A slightly higher premium for significantly better coverage, lower deductibles, or a more reputable insurer often offers greater long-term value and protection.

- Provider Reputation & Financial Strength: Research insurance companies. Check customer reviews, financial ratings (from agencies like A.M. Best or Standard & Poor's), and their claims handling reputation. A company that is financially sound and responsive to claims is crucial when you actually need their help.

- Leverage Independent Agents: Independent insurance agents work with multiple companies and can help you compare policies and find the best fit for your specific situation.

3. Decoding the Fine Print: Understanding Policy Terms

Insurance policies are legal contracts, and they can be dense. But understanding what you're buying is paramount.

- Read Everything (Yes, Really): Skimmed policies lead to surprises. Take the time to understand the specifics of your coverage.

- What's Covered (and Not): Pay close attention to what events, damages, or illnesses are explicitly covered. Equally important are the "exclusions"—events or situations that the policy will not cover. For example, some homeowners policies exclude flood or earthquake damage, requiring separate coverage.

- Deductibles & Limits: Know your deductible for each type of claim. Also, understand your policy limits—the maximum amount the insurer will pay out for a covered loss.

- Claim Process: Familiarize yourself with the steps to file a claim. What documentation is needed? What are the deadlines? Knowing this in advance simplifies a potentially stressful situation.

4. Life Changes? Review Your Coverage Regularly

Your insurance needs are dynamic, not static. What worked for you five years ago might be completely inadequate today.

- Annual Check-up: Aim to review all your insurance policies at least once a year. This helps you identify gaps, adjust coverage, and potentially find better rates.

- Major Life Events are Triggers: Don't wait for the annual review if a significant life event occurs. These are critical times to reassess:

- Marriage or Divorce: Changes in dependents, shared assets, and beneficiary designations.

- Birth or Adoption of a Child: Increased need for life insurance and medical coverage.

- Job Change or Promotion: Shifts in income, employer-provided benefits, and financial obligations.

- Home Purchase or Sale: New homeowners or renters insurance needs.

- New Car Purchase: Adjustments to auto insurance.

- Significant Debt or Asset Changes: Increased or decreased need for coverage.

5. Employer vs. External Policies: What's Best for You?

Many employers offer attractive insurance benefits, often at discounted group rates. While these are a great starting point, they rarely provide comprehensive, lifelong protection.

- Employer Policies: Pros and Cons:

- Pros: Convenient, often subsidized, easy payroll deductions.

- Cons: Coverage limits may be insufficient for your needs, tied to employment (lost if you switch jobs or retire), not always portable.

- External (Personal) Policies:

- Pros: Customizable to your exact needs, portable between jobs, can provide higher coverage amounts.

- Cons: Typically more expensive than group rates, requires individual research.

- The Smart Approach: Often, a combination is best. Utilize employer benefits for foundational coverage (like basic life or health) but supplement with external policies (like an individual disability policy or additional life insurance) to fill gaps and ensure consistent protection regardless of your employment status.

Common Questions & Misconceptions About Insurance

Even with the best intentions, people often misunderstand core aspects of insurance. Let's clarify some frequent questions.

"Isn't insurance just another expense I can cut?"

This is a common misconception. While insurance involves regular premiums, viewing it purely as an "expense" misses its fundamental purpose: risk management. It's an investment in your financial future, protecting you from potentially catastrophic losses that would far outweigh the cost of premiums. Skipping critical coverage is like driving without a seatbelt—you hope you'll never need it, but if you do, the consequences can be dire and irreversible. It's paying a little now to avoid losing a lot later.

"Can I just rely on my employer's insurance plans?"

Employer-sponsored insurance plans are a fantastic perk and often a great starting point for coverage, particularly for health insurance. However, they frequently have limitations. Group life insurance through an employer might offer only 1-2 times your annual salary, which is often insufficient to cover your family's long-term needs. Disability coverage might be short-term only or have strict caps. Moreover, these policies are tied to your job. If you switch employers, get laid off, or retire, that coverage often disappears, leaving you vulnerable. It's wise to assess if your employer's offerings are truly adequate and supplement them with personal policies for greater stability and customization.

"How much insurance coverage do I really need?"

There's no single answer to this, as it's highly personal. The "right amount" depends entirely on your unique financial situation, dependents, debts, assets, lifestyle, and future goals. For life insurance, a common rule of thumb is 7-10 times your annual salary, but a more accurate assessment involves calculating all your family's financial obligations (mortgage, education, daily living expenses, debts) and income replacement needs for many years. For health, aim for comprehensive coverage with manageable deductibles. For property, ensure replacement cost value. The key is to conduct a thorough personal needs assessment, as outlined earlier, rather than relying on generic figures.

Making the Smart Choices for Your Family's Future

Navigating the world of insurance can feel daunting, but approaching it strategically is one of the most proactive steps you can take for your family's financial well-being. It’s about being prepared, not paralyzed. By understanding the various forms of protection, meticulously assessing your personal needs, diligently comparing policies, and committing to regular reviews, you transform a complex topic into an actionable plan.

Insurance isn't just about recovering from a setback; it’s about having the confidence to pursue your goals, knowing that a strong safety net is in place. It's about protecting your hard-earned assets, securing your loved ones' future, and preserving your peace of mind. Start today: assess your current coverage, identify any gaps, and take the necessary steps to build the comprehensive financial fortress your family deserves. The time to protect against unexpected financial shortfalls is now, before the next curveball comes your way.